Mortgage valuation problems & what property defects are mortgage lenders looking for in their valuation? When you are arranging a mortgage the lender will carry out a basic mortgage valuation. This article covers the Top 10 Mortgage … [Read more...]

What documents do I need to get a Residential Mortgage?

In this post I will try to clarify what documents are needed in order for you to get a mortgage. Please can I start by stating that since the FCA Mortgage Market Review (MMR), the level of documentation required by the lenders as well as brokers has … [Read more...]

Mortgage with a criminal record

Tips on getting a Mortgage with a criminal record and how to source the right mortgage in the UK if you have been to prison. I am a firm believer that people who have paid their price should always be given a second chance. Unfortunately this may … [Read more...]

Why its time to Remortgage to a fixed rate

5 year Fixed Mortgage rates from 2.44% maybe its time to Remortgage to a fixed rate now In recent years remortgages have not been as popular as they once were as rates have been so low, however both the Chancellor and Governor of the Bank of England … [Read more...]

Buy to let Mortgage Limited Companies

Key points on Buy to let Mortgage Limited Companies and how the finance side of things work Following the budget landlords have been turning to limited company wrappers for their portfolios but is there only an upside? Moving assets out of an … [Read more...]

Deposit levels needed to get a Mortgage with a default

Your guide on getting a Mortgage with a Default. Read below about how much deposit you need and what are the maximum limits on past defaults. The good news is I specialist in mortgages for customers with defaults on their credit file. The bad … [Read more...]

Deposit levels needed to get a Mortgage with a CCJ

How much deposit do I need to get a Mortgage with a CCJ This article is about obtaining mortgage finance if you have a county court judgement (ccj). It is aimed at residential mortgage customers who want a conventional mortgage; it is not open to … [Read more...]

Mortgage with bad credit Update July 2015

Getting a Mortgage with Bad credit including CCJs, Default, Missed payment and debt management plans. Residential and Buy to Let Mortgages with Bad Credit Missed payments on loans and Credit cards County Court Judgements (CCjs) And … [Read more...]

Halifax withdraws its 1% cashback first-time buyer mortgages

Halifax in a shock withdrawal of its 1% cashback mortgage incentive for first-time buyers only giving a few hours for full application to be submitted. I was very disappointed to read an email timed at 4 O’clock this afternoon notifying us that … [Read more...]

5 things you need to know about getting a mortgage with a Visa

If your a Foreign national looking to get a mortgage with a Visa you really need to read my tips 1. Not all brokers are the same When it comes to foreign national mortgages and getting mortgage with a Visa things are likely to be different … [Read more...]

HMRC SA302 & Tax Year Overviews for getting a Mortgage

Evidencing income you self-declare tax on - SA302 & Tax Year Overviews for Mortgage Lenders. A HMRC SA302 & Tax Year overviews will be required for any given year requested. Please read below … [Read more...]

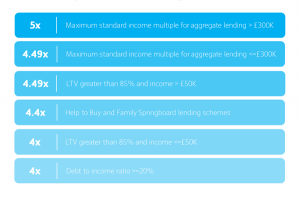

Woolwich Mortgages have made another change to their affordability criteria

Woolwich will now lend up to 5 times income for certain type of mortgages. Surprise, surprise Woolwich Mortgages have decided to change their mind again and put in yet another income multiple revision. Historically Woolwich mortgages was one of the … [Read more...]

Abbey – Santander changes Mortgage income rules for First Time Buyers

Bad news as Abbey - Santander changes Mortgage income rules for First Time Buyers to 4.49x income. As if things where not bad enough we have seen yet another lender real under pressure of the regulators by introducing even more prudent loan to … [Read more...]

Guide to getting a Mortgage for self-employed applicants

2015 guide on getting a Mortgage for self-employed applicants. A must read for all entrepreneurs looking to buy property. Following the regulatory mortgage market review (MMR) last year the lenders have implemented changes to the way they assess … [Read more...]

Different lenders affordability criteria

Where do I stand on the lenders affordability criteria, following all the changes in recent months? Maximum affordability is the ‘real issue’ facing the UK mortgage market, and not rates. In this article I will explain why rate has become secondary … [Read more...]