Use Mortgage overpayment without changing your product and contract.

In this article, I reveal the impact of how adjusting your mortgage repayment strategy using Mortgage overpayments can substantially financially benefit you rather than the bank.

Sure, Mortgage Lenders help you finance house purchase but don’t be fooled into thinking they are not commercial beasts with their own interests at heart. The way that a typical residential mortgage is structured in the UK is on a capital and interest repayment basis over 25 years.

The reality is for the most part of the mortgage term the interest component of the repayment is high, and inroads into the capital reduction only accelerates towards the end. In other words, you are paying for borrowing the money, but not really repaying the amount borrowed, and as interest is charged on the outstanding balance it works firmly in the banks favour.

TERM

The “term” i.e. the length of time you borrow money over is king. In fact to simply the longer the term the greater the smile on the bank’s face, as although you monthly costs will be cheaper because of the spread, you will be borrowing the money and being charged interest for the privilege for longer. In fact, it is common for mortgage lenders to put a minimum term of 5 years into their contracts as otherwise it would not be profitable enough for them.

If you can afford to pay over the contractual monthly payment, and are disciplined, then a term reduction is a reality. And, as I say it’s all about concertinaing this term as much as you can.

The impact of regular monthly overpayments

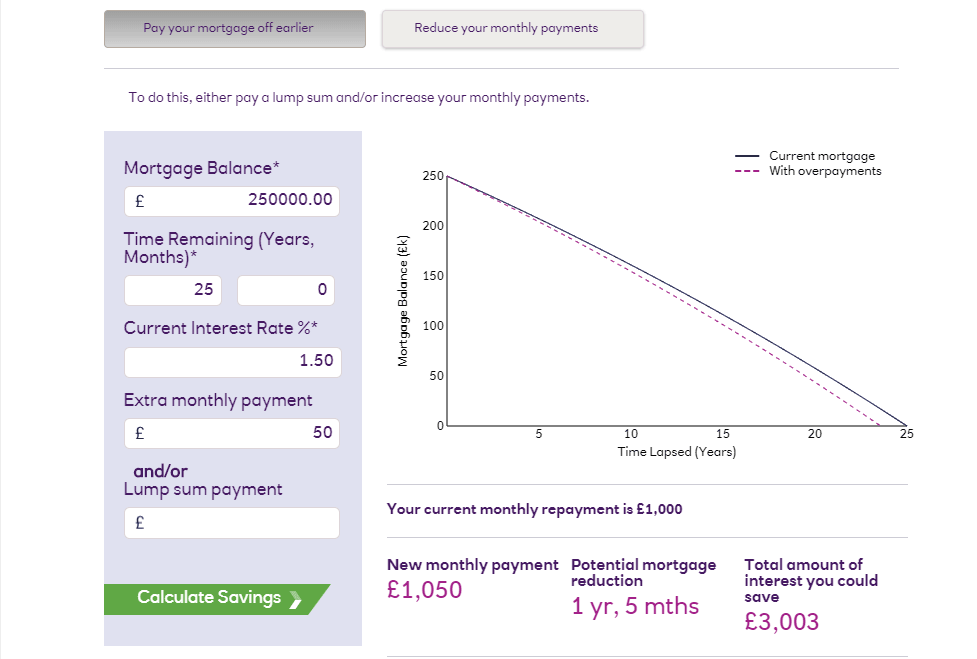

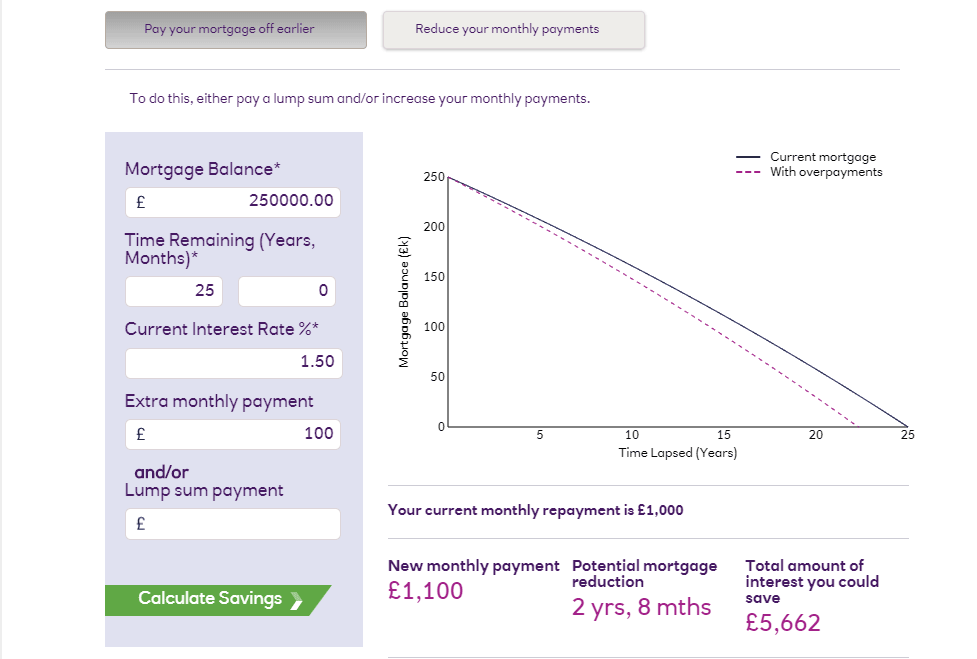

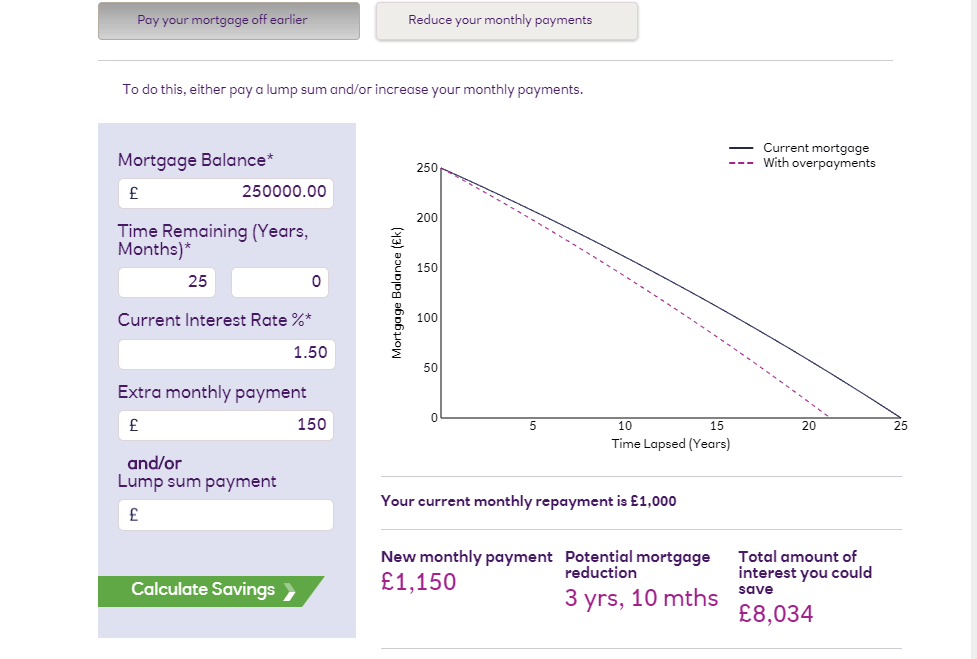

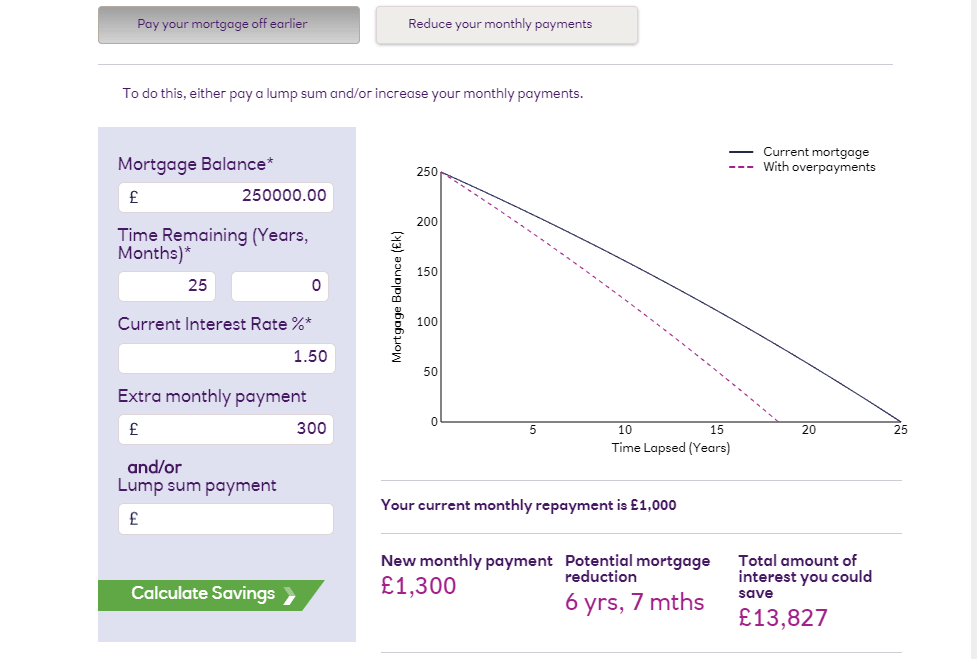

Taking a typical repayment mortgage of £250,000 over 25 years, assuming an interest rate of 1.5%. NatWest’s overpayment calculator reveals:

| Paying an extra, a month | Term reduction |

|---|---|

| £50 | 1 yr , 5 Months |

| £100 | 2 yr , 8 Months |

| £150 | 3 yr , 10 Months |

| £300 | 6 yr , 7 Months |

CAPITAL

As stated above the capital is the amount borrowed and this is barely touched until the later stages of the mortgage, however you could directly attack this in the early years with a lump sum overpayment. Most Mortgage Lenders allow up to 10% capital reduction per annum without main early repayment charges applying and it may have a profound impact.

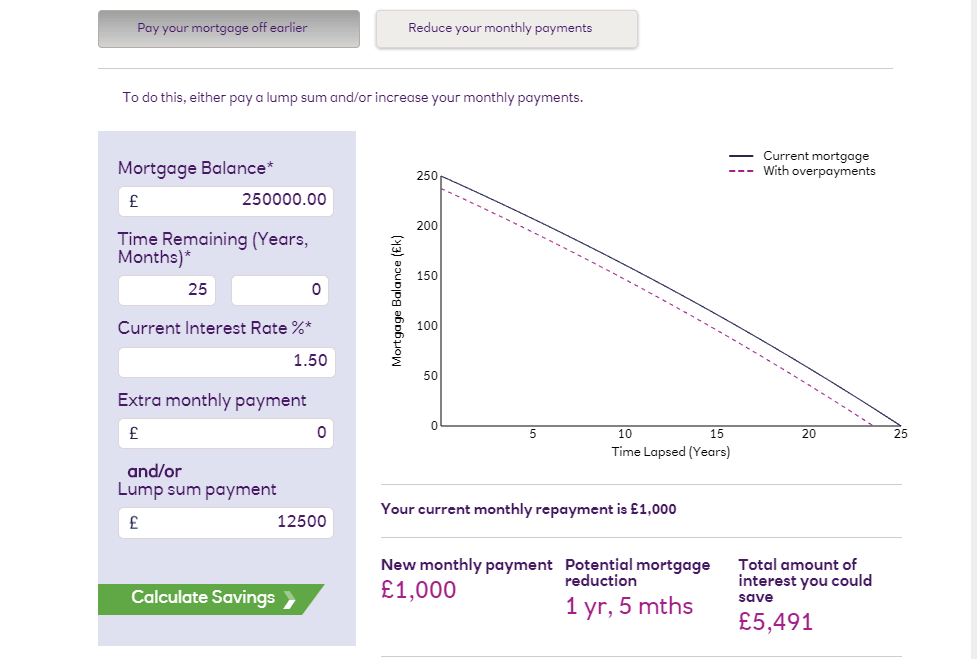

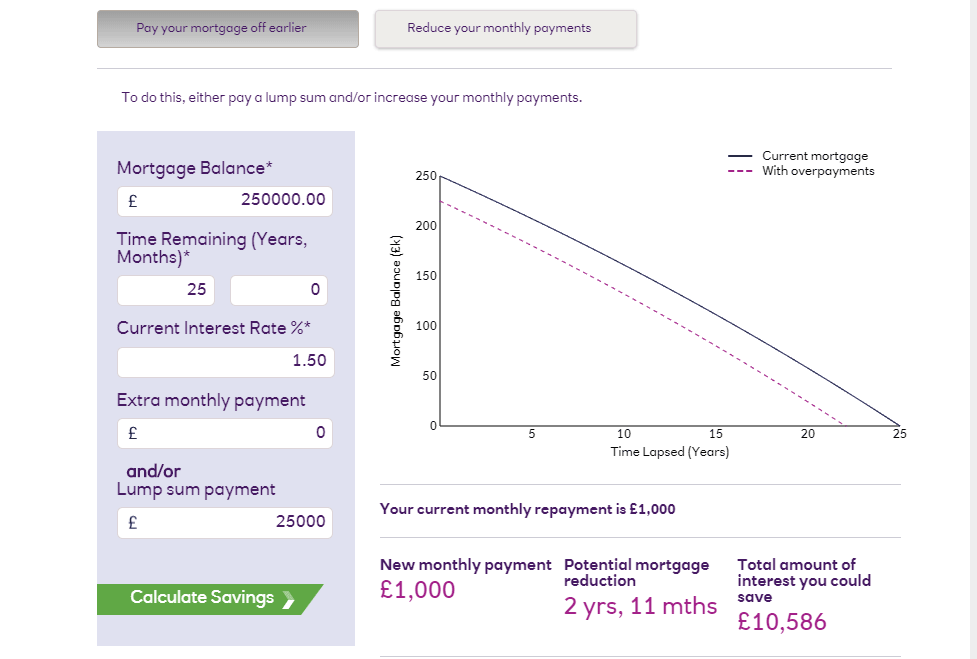

The impact of lump sum overpayments

Taking a typical repayment mortgage of £250,000 over 25 years, assuming an interest rate of 1.5%. NatWest’s overpayment calculator reveals:

| Paying an extra, % of your mortgage balance in a year | Term reduction |

|---|---|

| 5% which is £12500 | 1 yr 5 Months |

| 10% which is £25,000 | 2 yr 11 Months |

Offset Mortgages

There are also Offset mortgage products which can use the balance of a current or savings account to counterbalance the capital and save interest. Depending on your circumstances including your Tax bracket, current savings, and your monthly savings plan Offset mortgage products can be this can have a dramatic effect on how your mortgage is repaid.

SUMMARY

There is, of course, nothing to stop you combining regular overpayments with lump sum overpayments providing they are affordable, for the best of both worlds. It’s very important you double-check the lender’s Mortgages terms and conditions to make sure they do offer an overpayment facility as not all lenders will allow for this but allowed I really think you should take advantage of this to pay down the mortgage faster.

I’m a professional Mortgage Broker and I should be delighted to talk this through all scenarios with you around Mortgage overpayments.

Free, No-Obligation Quote today!

By completing this form you are allowing us to respond to the query by phone, email SMS and our messaging software.

The graphs used in this article have been produced on the Barclays Bank website.