Remortgage to pay off debts but what can you consolidate into a remortgage or second charge secured loan? Mortgage Lenders may allow you to raise money to pay off debts for a variety of reasons so a remortgage to pay off debts is a route that many … [Read more...]

Loan to value LTV limit for a remortgage

Does the loan to value - LTV product limit a remortgage amount? How to loan to value limits work? You may have seen Lenders quoting loan to value / LTV limits for their remortgages on their websites and literature but what does it all mean? The … [Read more...]

Getting a buy to let mortgage but have been away abroad in the last three years

I want to get a buy to let mortgage but have only been back in the UK for 12 months before that I was living and working abroad. Most buy to let mortgage lenders have got a ‘two or three year UK residency rule’ whereby they expect the applicants to … [Read more...]

Mortgage with one year accounts

I’m about to file my first years accounts which are looking healthy. Can I get a Mortgage with one year accounts? The good news is there are a number of lenders who are now offering the self-employed a Mortgage with one years accounts. There are key … [Read more...]

What is a Secured Loan?

What is a secured loan and how does it differ from a personal loan? A secured loan is essentially a second loan put behind a traditional first charge mortgage. The secured element comes from the right the lender will have to potentially repossessing … [Read more...]

Mortgage for doctors, nurses and other NHS staff

Getting a mortgage if you are employed as a Surgeon, Doctor, Nurse, ambulance services or any other part of the National Health Service We are getting an increasing number of enquiries from applicants who work for the National Health Service who are … [Read more...]

How can I get a Mortgage over five times salary

Can you still get you a mortgage over five times salary and if so what is needed The answer is “yes” but it depends on your personal circumstances but its not going to be easy to get a mortgage over five times salary. In short the maximum income … [Read more...]

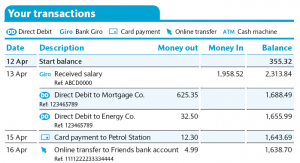

What do mortgage lenders look for in your bank statements?

If you are applying for a mortgage then the chances are the lender will want to see your bank statements, but why are these relevant? … [Read more...]

What documents do I need to get a Residential Mortgage?

In this post I will try to clarify what documents are needed in order for you to get a mortgage. Please can I start by stating that since the FCA Mortgage Market Review (MMR), the level of documentation required by the lenders as well as brokers has … [Read more...]

Uk’s Cheapest 10 year fixed mortgage

Niche Advice and Woolwich for Intermediaries offers Uk’s Cheapest 10 year fixed mortgage at 2.99% From tomorrow 07/01/2015 we are introducing the UK’s lowest ever 10 year fixed rate mortgage at 2.99% for residential loans up to 60% LTV. The … [Read more...]