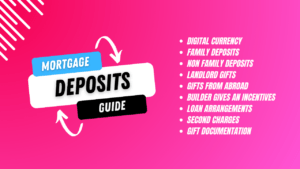

If you are a home buyer, then you really need to understand how mortgage deposit rules work in the UK. In a recent video, expert mortgage broker Payam Azadi delves into the complexities of mortgage deposit criteria and the specific documentation … [Read more...] about Understanding Mortgage Deposit Lending Rules: Video Insights from Payam Azadi

Mortgages

Mortgage and product news, best buys and tips

How to Buy a Property and get a Lease extension with a Mortgage

Lease Extension - How to Secure a Mortgage for a Short Lease Property and Extend It If you want to buy a property and need a Lease extension mortgage, this article is for you! Properties with short leases can be bargains and allow you to … [Read more...] about How to Buy a Property and get a Lease extension with a Mortgage

Right to Buy Mortgage Declined? Here’s How to Turn It Around!

Right to Buy mortgages can lead to more declines than standard purchases. There are a variety of reasons for this, and don’t despair just yet as we are experts in the Right to Buy mortgage field, and we may well be able to help. In this article we … [Read more...] about Right to Buy Mortgage Declined? Here’s How to Turn It Around!

Remortgage to pay a Tax Bill – Common mistakes

Common mistakes made when Remortgage to pay a Tax Bill If you are reading this article, you may have already fallen into the trap of thinking Remortgage to pay a Tax Bill is straight-forward, well it isn’t, and the wrong positioning and lender … [Read more...] about Remortgage to pay a Tax Bill – Common mistakes

The 2025 Stamp Duty Changes: What Homebuyers Need to Know

It’s going to be a hectic start to 2025 for the “Mortgage World” as buyers scramble to purchase properties before the changes in England, brought about by Chancellor Rachel Reeves, come in 1st April on Stamp Duty Land Tax (SDLT). From my own … [Read more...] about The 2025 Stamp Duty Changes: What Homebuyers Need to Know

How to Avoid Common Remortgage Mistakes and Improve Approval Chances

Common Remortgage Mistakes to Avoid: Expert Tips for Faster Approval Background Remortgage Lenders will have their own set of rules as to what is an acceptable reason to raise money – so don’t be caught out so lets take a look at the Common … [Read more...] about How to Avoid Common Remortgage Mistakes and Improve Approval Chances

Interest Only Debt Consolidation Remortgage

A guide to Interest Only Debt Consolidation Remortgage Debt consolidation is the process used to describe combining debts. Interest only is where you are only paying the interest on the amount you’ve borrowed but are not reducing the debt. Debt … [Read more...] about Interest Only Debt Consolidation Remortgage

Right to Buy – Met the deadline – what happens next?

If you got your Right to Buy application in by the 21st November 2024 deadline here is what to expect. Right to Buy Application Process and Timeframe Guidelines 1. Track Your Application Progress 3. Right to Buy Section 125 Offer … [Read more...] about Right to Buy – Met the deadline – what happens next?

Right to Buy discount date confimed by Goverment

We now know when the Right to Buy discount cut-off date will be. We wanted to bring your attention to some significant updates regarding the Right to Buy process following a government announcement in this week's budget. You can get a Right to … [Read more...] about Right to Buy discount date confimed by Goverment

Should You Remortgage to Pay for a Wedding and Honeymoon?

Image by StockSnap from Pixabay Remortgage to Pay for a Wedding or Getting Finance Another Way? Remortgage to Pay for a Wedding or not? Paying for a wedding and honeymoon is one of the most expensive but rewarding times. I don’t need to tell … [Read more...] about Should You Remortgage to Pay for a Wedding and Honeymoon?